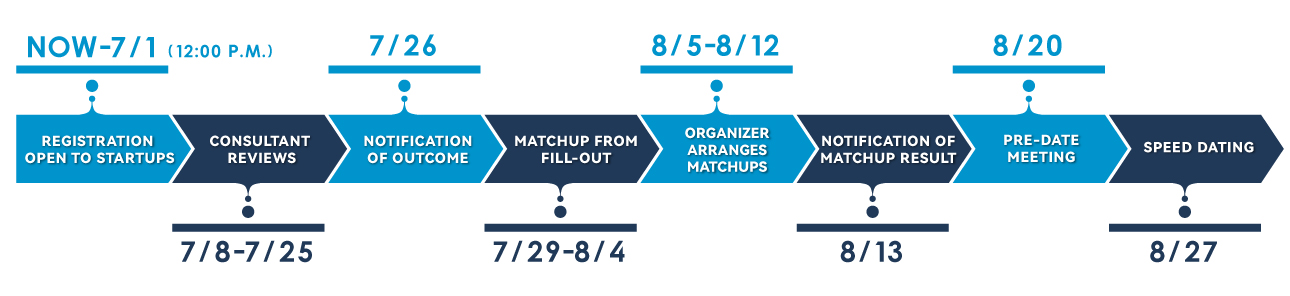

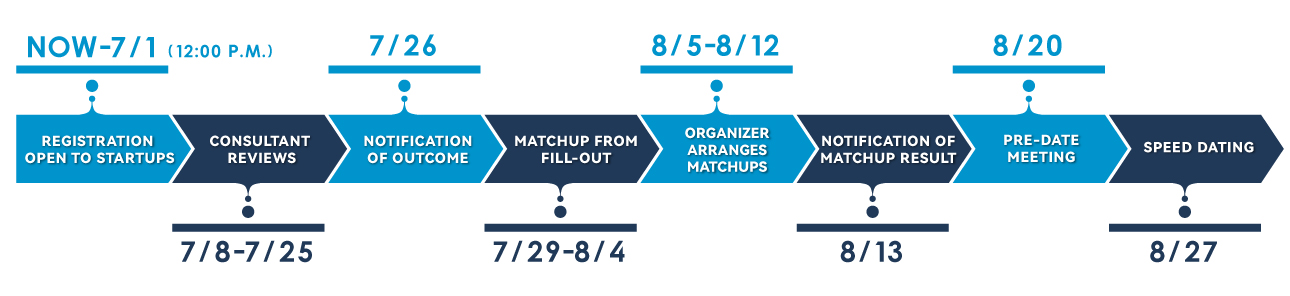

SCHEDULE & STEPS

FACE TO FACE INTERACTION WITH EARLY STAGE INVESTORS TO SEEK FOR INVESTMENT OPPORTUNITY; CONNECT DIRECTLY TO INVESTMENT RESOURCES FOR FURTHER DEVELOPMENT

To create opportunities for startups to interact individually with investors, we will hold FINDIT Speed Dating on the afternoon of Aug. 27 (Wed.), proceeding in a series of "10-minute one-on-one interaction". This event will invite 30 domestic and international investors present in total, and will openly select 30 startups to interact with investors.

- See the outcomes of 2016, 2017,2018, 2019, 2020 , 2021 , 2022 , 2023 and 2024 Matchups in FAQ

104 Job Bank, established in 1996, has been a leading provider of integrated human resource services in Taiwan. In 2006, 104 Corporation was the first internet company listed on the Taiwan Stock Exchange. Consistently as Taiwan’s most visited human resources service website, the Company remains steadfast in its mission of being the leading brand in human resources across the Chinese-speaking world. In pursuing industrial innovation with C.M.O.S.A. (Cloud-based, Mobile Apps, Open platforms, Social media, and Artificial Intelligence) as core concepts, the Company provides a comprehensive range of HR-related services and management solutions, including online talent acquisition and recruitment, career exploration, course learning, mid & c-level headhunting, HR Portal, HR Academy, payroll management, testing and assessment, HR consulting, and employer brand.

Brenda Shih / Vice President

Lucas Lu / Manager

Portfolio

SparkLabs Taipei Fund 1, Wiedu Corp.

Fields of Investment

HR Tech, EdTech, AI, Content Innovation, etc

Investment Rounds

Seed to Pre-IPO

Our organization was established in December 2020 with a primary focus on financial commodity investing operations. We take pride in having an extraordinary management team committed to the long-term viability and growth of the business we operate.

Barry Lin / Consultant

Portfolio

Fields of Investment

High-tech applications, Innovative technologies, New energy, Green energy, Biotechnology and medical materials

Investment Rounds

Series A

AVA have an angel club and an early-stage fund. Through systematic collection of a wide range of case sources, each angel investor can discuss in depth, and gather the resources of angel investors to improve the overall evaluation ability and increase investment influence. The AVA management team assists in the evaluation of investment projects and post-investment management, so that each investment case can achieve the best return.

JJ Fang / Founder/ CEO

Portfolio

FST Network, Vocus, Moovo, Rosetta.ai, Conflux Yacht, Mr. Living, Lypid, ECOCO

Fields of Investment

AI, IoT, Big Data, Internet, Software, E-commerce, Education,ESG

Investment Rounds

Seed to series A

Established on April 10th, 2014, B Current Impact Investment is a collaborative effort of 43 prominent leaders hailing from various backgrounds and professions in Taiwan and Silicon Valley. As Taiwan’s premier impact VC fund supporting impact-driven businesses, Fund 1 was conceived through club funding, an innovative fund raising model. Moving forward, newly formed funds are managed by Fund 1, serving as their fund manager or General Partner.

John Kan / Investment Manager

Portfolio

Greenvines, Better Milk, Micro Electricity, Bened Biomedical, Tsaitung, The Can, Backer-Founder, Happ.

Fields of Investment

Climate Technologies, Sustainable Agriculture, Healthy Lifestyle, Inclusive Economy

Investment Rounds

Pre-A to series A

Chunghwa Investment Co., Ltd. is a Corporate venture capital led by Chunghwa Telecom Co., Ltd. Chunghwa Investment mainly assists startup companies via strategic investment and consulting, and connects with CHT Group's business and product units.

George Lin / Manager

Tom Chen / Commissioner

Portfolio

ioNetworks INC, imedtac Co., Ltd., Taiwania Capital, PCHOME ONLINE INC.

Fields of Investment

smart city, AI, content, fintech, advanced manufacturing, eHealth, metaverse

Investment Rounds

After pre-A

Cornerstone Ventures primarily invests in digital teams and seeks those that can leverage artificial intelligence and other new technologies to impact the market. Cornerstone prioritizes startup teams with connections to Taiwan, including those with significant operational performance in Taiwan, Taiwanese startup teams overseas, and international teams planning to enter the Taiwanese market.

Sara Chen / Associate

Portfolio

AlleyPin, AsiaYo, FundPark, Shopback, USPACE

Fields of Investment

Digitalization, artificial intelligence, financial technology, IoT

Investment Rounds

seed, series A-C

CSC Venture Capital Corporation combines the resources of CSC Financial Group, which is highly connected to the capital market. At the same time, it has successful execution experience in venture capital and financial advisors. Combined with group resources, it can provide the investee company with long-term and stable financial resources and a complete listing plan. , Professional counseling team, comprehensive distribution channels and complete financial services, one-stop service from the initial stage of corporate investment support to the subsequent stage of corporate listing counseling.

Sid Liu / Assistant Vice President

Portfolio

Mobagel、Hahow、Wstyle、Neweb Technologies、Han Biomedical

Fields of Investment

AI、SaaS、TMT、ICT、AIoT、Semiconductor、Medical Devices、New Economy

Investment Rounds

Series A to Pre IPO

Darwin Venture Management is a boutique venture investment firm headquartered in Taipei, Taiwan, with offices in Hsinchu and the United States. Since our founding in 2009, we have managed nine funds, investing primarily in Series A/B, late-stage, and secondary funds. In 2022, we also launched an evergreen angel fund to enable more nimble bets on promising early-stage teams, and especially those coming from Taiwan’s superb academic and research institutions. This exposure across stages and borders, coupled with the strong technical background of our team, is the source of Darwin’s differentiation.

Jason Lu / Director

Portfolio

funP, Clearmind, Proxifile, SiAT, High Entropy Materials Inc., Ufi Space Co., Ltd., Spirit Scientific Labs, CardioRing, Numbers, KKday, iCHEF, inline, Fansi, EUI, Spiderlabs, Flow Solution, Lungteh Shipbuilding Co., Ltd., Red Leader, Nelumbo, iVideosmart, bubbleye, Carota, Atgenomix, Jubo Health, Gamma, Camlann Games, Zehitomo, BallWave, 3DPC, Syncell

Fields of Investment

Prospective technology, digital economy, medical care, innovative materials

Investment Rounds

Seed and series A

E.SUN Venture Capital was established in 2002, and it is also wholly owned by E.SUN Financial Holding Company. E.SUN Venture Capital is dedicated to offering total financial solutions for corporate clients. It leverages E.SUN Financial Holding Company’s extensive resources and offers an extensive range of financial services for corporate clients at different stages of business development.

Jason Fang / Manager

Portfolio

DOMIN-TEK CO, RePV Tech, SongChuan, Xrex, Ikala, Vpon, Aiello, Creative Tech Textile, CHO Pharma, Vactronics Technologies,Pi Mobile Technology, Vizionfocus

Fields of Investment

Electronics, Chemical , Smart Manufacture, Green Energy Technology, Biotechnology and Pharmaceuticals, Medical Devices, Digital Economy, Cultural and Creative Industries and other Industries

Investment Rounds

Pre-A to Pre-IPO

Global power supply leader FSP Group (stock code: 3015) has partnered with Mosaic Venture Lab (MVL), a venture accelerator focused on digital healthcare, smart mobility, and semiconductor innovation, to establish an incubation fund. This fund aims to support Taiwanese startups, with a focus on specialized applications in the semiconductor, mobility, and artificial intelligence industries.

Johnny Yu / Managing Director

JEmily Wang / Investment Manager

Portfolio

Officially launch in the third quarter of 2025

Fields of Investment

Semiconductor, mobility, and artificial intelligence industries.

Investment Rounds

Seed~ B round

Genesis Capital Limited was founded by Dr. Wu-Fu Chen, a renowned figure in the venture capital industry, and is chaired by Mr. Po-Hsun Chen. Dr. Wu-Fu Chen is one of the founders of the 3G mobile communications standard and is a leading figure in the venture capital industry. Mr. Po-Hsun Chen, who has extensive experience in financial management and renewable energy entrepreneurship, is responsible for the operation and management of the company. Genesis Capital Limited aims to accompany the growth of new enterprises through the concept of "input and innovation". Our core value lies in three key strengths: breadth of resources, depth of counseling, and flexibility in decision-making, with fundraising and financial consulting as our key strengths. In addition, our strategic partners will be a strong support to our portfolio companies and all investors.

Charles Hsieh / General Manager

Ami Lin / Manager

Azure Shen / Assistant Manager

Portfolio

CMIT、MAYO、PlayNitride、Tech-Zone、TRIO、AP Biosciences、GOGOLOOK、FOXTRON、SEETEL、Diamond Biotechnology、Uniconn、WHALECHIP、Wieson、TIAN YUAN、Forward、ALifecom

Fields of Investment

unlimited

Investment Rounds

Before Series B, After Series B

Golden Canyon Venture Capital Investment Co.,Ltd is a 100% subsidiary of the listed company Chien Kuo Construction Co., Ltd., and its main business is to invest in unlisted companies with development potential.

Jonathan Lee / General Manager

Portfolio

Locus Cell 、MEGA UNION TECHNOLOGY、Brain Navi、Phoenix Pioneer technology、TCM BIOTECH INTERNATIONAL、Revivegen、AuthenX

Fields of Investment

unlimited

Investment Rounds

Expansion period

Harbinger was formed in 2000 as a new venture fund by senior executives from Mitac-Synnex Group, with the aim to help startups optimize the opportunities between Greater China and USA.

Through strenuous guidance and continuous supports, step by step we built a strong portfolio, of which 73 companies successfully went public or being acquired. We take pride in building a win-win platform, which helps our portfolio companies realize their visions.

In our drive to nurture the next unicorns, Team Harbinger will continue to identify and partner with promising teams and foster the leaders of tomorrow.

Robert Chen / Investment Associate

Portfolio

ProfetAI、DotDot Inc.、Ally Transport、GLOBAL POWER TECHNOLOGIES、JG-SSG CO、Lianyou Metals、Infinite、永豐餘實業

Fields of Investment

Next Gen Computing & Communication、Innovative Precision Instruments、Biomedical、Novel Materials、Disruptive Services & Enablers、Mobility Redefined、Legacy Reinvented、Green Energy

Investment Rounds

Pre-A to Pre-IPO

Headwater Capital is committed to establishing long-term trust relationships with investment portfolio teams. We employ the highest standards in post-investment management and engage in direct discussions with portfolio team members to address the challenges encountered at different stages, leveraging our respective expertise and experience to collectively overcome these issues and nurture the growth of the project company.

We respect the professional fields and judgments of the portfolio team members. Therefore, we focus on providing additional value to the portfolio team, such as funding, corporate financial planning, business expansion, equity structuring, and legal counsel for startups. Our focus lies in bringing more fruitful collaborations to the portfolio team by partnering with industry experts from diverse fields, offering comprehensive assistance to enhance the services provided by the portfolio team.

Venson Wang / Founder

Lex Wang / Founder

Portfolio

Digit Spark, Golface, Sciket, Zocha, Pixal Canvas, ZTQ games, Dentall, Nxvet.

Fields of Investment

Platforms, Sustainability, Web3, E-Commerce

Investment Rounds

Seed to Pre-A

Hive Ventures invests in early stage teams, who seeks to develop the building blocks of the SMART Hyperconnected world.

Ryan Chang / Principal

Portfolio

Canner, PicSee, Botrista, ProfetAI, InstillAI, InfuseAI, IsCoolLab, KryptoGO

Fields of Investment

AI, Big Data, IoT, SAAS, Blockchain

Investment Rounds

Seed to series A

Intellectual Property Innovation Corporation (IPIC) is a new venture which is spinoff from ITRI. Operating as a wholly owned subsidiary of ITIC, IPIC aims to help capital investment of the domestic startups or enterprises, provide patent analysis service, assist researchers commercialize their invention, and enhance industry competitive advantage. Services include diversified capital investment and integrated IP management.

Xiao Zhen Wang / Assistant Manager

Portfolio

Seer Microelectronics, Inc., Taiwan Electron Microscope Instrument Corporation, KNCKFF Co., Ltd., InterAgent Co., Ltd., Orion go Co., Ltd., Phoenix Pioneer technology

Fields of Investment

All kinds of early technology

Investment Rounds

Seed, angel round

Mega International Commercial Bank Co., Ltd. (Mega Bank) has come into being as a result of the merger of The International Commercial Bank of China and Chiao Tung Bank, effective on August 21, 2006. Both banks have been proud of their longtime histories of outstanding track records in our country. Building on the professional advantages inherited from The International Commercial Bank of China and Chiao Tung Bank, the Bank leads the domestic banking industry in various areas, including international trade and foreign exchange, international syndicated loans, project financing, and innovative and venture capital. Leveraging the advantage of its global presence and correspondent banks, the Bank has made immense contributions in supporting domestic companies to expand internationally, upgrading industrial, and promoting economic developments. In recent years, by following the footsteps of peers in advanced countries, the Bank is dedicating all efforts to optimizing corporate governance and promoting sustainable development.

Jack Han / Assistant VP

Portfolio

PharmaEssentia Corp, International Integrated Systems, Inc., Boretech Resource Recovery Technology Co., Ltd., Taiwan Aerospace Corporation, Ta Tun Electric Wire & Cable CO.,LTD.

Fields of Investment

There are no restrictions on the industries that banks can engage with

Investment Rounds

Growth to Extension Stage

Venture Capital

Kai Tseng / CEO

Portfolio

ADAM elements、Matthew‘s Choice、KKCK Corp. LTD、Le blé d'or

Fields of Investment

Electronics Industry, Consumer Goods, Beauty and Skincare, Food and Beverage

Investment Rounds

Pre-A, Series A, Pre-IPO

Saga Unitek Venture is a professional venture capital and private equity fund management company, specializing in investing in middle-market, growth-oriented companies in China, Taiwan and the US. Our primary goals are to add value to our portfolio companies and consequently deliver a better return to our fund investors. We practice a hands-on approach. Each of our partners has in-depth, hands-on experience in operating and managing companies. Saga Unitek manages a sophisticated network and framework of quality deal sourcing. The company consistently reviews over 300 deals every year. We provide venture capital and growth capital to fledgling companies with growth potential, proprietary advantage in its chosen segment.

Alex Tsai / Vice President

Portfolio

Laster Tech Co., Ltd., Newmax Technology Co., Ltd., G-tank International Co., Ltd., Yorkey Optical International (cayman) Limited, Unique Optical Industrial Co., Ltd., Formosa Advanced Technologies Co., Ltd., Subtron Technology Co., Ltd., Viking Tech Corporation, Leadtrend Technology Corporation, Asolid Technology Co., Ltd., Health Ever Bio-tech Co., Ltd., Wegoluck Co., Ltd., Genovior Biotech Corporation, Gemini Data, E-vehicle Semiconductor Technology Company Limited, Focaltech Smart Sensors Co., Ltd., Focaltech Smart Sensors Co., Ltd., Alar Pharmaceuticals Inc.

Fields of Investment

Biotech, Agriculture technology, optoelectronic, semiconductor, Internet, Software

Investment Rounds

Angel, pre A, series A, series B and series C

In 2018, SET Group launched SET Studio Park, strategically investing in emerging lifestyle sectors such as tourism, pet care, and leisure entertainment — a bold move reflecting its vision for cross-industry integration and diversified growth.

Jerry Wang / Director

Portfolio

Pushin Ranch、Wanpi World Safari Zoo、Walkgame、Taroko Sports、Formosa Electronic Industries

Fields of Investment

Travel and Tourism、Pets、Energy Storage、Entertainment

Investment Rounds

Angel, pre A, series A, series B and series C

Using Shin Kong Mitsukoshi department stores as a platform to empower portfolio companies and build a consumer-focused ecosystem around Shin Kong Mitsukoshi.

Veronica Chen / Assistant VP

Portfolio

Turn Cloud

Fields of Investment

Smart retail, General Consumer Sectors including brands and supply chains

Investment Rounds

Seed, Pre-A, A to Pre-IPO

SparkLabs Taiwan is a Taiwan Focus startup accelerator & VC fund that’s the beachhead for the outside, and a digital transformation catalyst for the inside. We invest in all the startups selected into our accelerator program with our own fund and assist them to go global and secure the next round of funding.

Mallory Chien / Senior Program Manager

Hsiang Hsu / Program Manager

Portfolio

H2U, FunNow, Pickupp, GRAID Technology, Just Kitchen, Kneron, Amazing Talker, Jmem tek

Fields of Investment

The full-range application of AI and data technology

Investment Rounds

Pre-Seed to Series A

Sustainable Impact Capital (SIC) is an investment network formed by entrepreneurs from various fields. We focus on the United Nations’ 17 Sustainable Development Goals (SDGs) and search for potential startups that can solve these problems. We invest in and assist them in growing, playing diverse roles such as social innovation lab, incubator, and community center.

SIC’s angel members also regularly exchange various startup knowledge, networking resources, business opportunities, and unique ecosystems to expand social impact. We believe that entrepreneurs, business leaders, NPO organizations, and everyone can drive creation and change and generate impact around the world.

Amos Huang / Co-Founder & Managing Partner

Portfolio

CBC SPACE、HOTCAKE INC、Nandina REM、Alpha Intelligence Manifolds、CW Materials、Earthgen Tech、PackAge+、SurgiBox、DataYoo、3EGREEN TECHNOLOGY、CancerFree、Fluv、Surglasses、Ccilu、GoSky, etc

Fields of Investment

SAAS、、AIOT、AI、Agriculture technology、Biotech、ESG material、other(new business model)

Investment Rounds

Angel

Taiwan Mobile Co. (TWM) is a leading telecom operator providing mobile, fixed-line, cable TV and broadband services.

Ken Chang / Principal

Portfolio

91APP, Cloudmile, Soundon, 17Live, Wemo, Uspace, etc.

Fields of Investment

Cybersecurity, cloud, AI, mobility

Investment Rounds

Series B to Pre-IPO

In order to drive domestic investment energy and enhance economic growth momentum, the National Development Council combined with private forces to establish the "Taiwania Capital Management Corporation". The company has raised two funds-"New Technology Fund (Taishan Buffalo)" and "Biotech Medical Fund (Taishan Buffalo No. 2)".

Andy Ho / Senior Investment Manager

Portfolio

Kdan Mobile Software Ltd., DCARD TAIWAN LTD., ANNJI PHARMACEUTICAL CO., LTD., EirGenix Inc., SyneuRx International (Taiwan) Corp., Canner, Inc., URSrobot AI Inc., Tantti Laboratory Inc., Cognito Health Inc., MECHAVISION INC., Ubiik Inc., etc.

Fields of Investment

IoT, Biotechnology and Medicine

Investment Rounds

Early to Extension Stage

TFB Capital is a venture capital company which is wholly owned by Taipei Fubon Bank

Loren Wu / Investment Associate

Wiki Liu / Investment Associate

Portfolio

13 investments in fintech and smart manufacturing in Asia, America and Africa

Fields of Investment

FinTech and the “Five Plus Two Industry Innovation Plan” promoted by the Taiwanese government

Investment Rounds

Series A to Pre IPO

The Tsinghua Angels Club was initiated by alumni of National Tsing Hua University, Taiwan, in 2017. It was founded out of gratitude towards their alma mater and a desire to give back to society. The association aims to assist young entrepreneurs in the early stages of their ventures by leveraging the collective power of alumni.

Through support in areas such as financial planning, fundraising, business models, risk management, corporate networks, industry trends, product marketing, and business management, the association provides appropriate assistance and facilitates experience sharing. Its goal is to help startups grow and thrive, nurturing a new generation of entrepreneurs and creating a positive cycle for Taiwanese society.

Freeza Huang / Secretary General

Portfolio

TSA、Hahow、TRESL、Crescendo Lab Ltd.

Fields of Investment

Software、SaaS、Digitial economic、Biotech、Eletronic、ESG

Investment Rounds

Angel, Seed, Series A

Founded in October 2010, Yu Tong Construction specializes in land development and residential construction. In 2023, the company expanded its operations by establishing an investment department in Taipei, focusing on startups and securities investments.

Chris Chen / Director

Portfolio

Figur8 (USA)、VOCXIHEALTH (USA)、GoodFin Fund (USA)、Flat Medical Inc. (BVI)

Fields of Investment

Investing primarily in light assets is the main investment principle. Key industries include biotechnology, AR VR XR, blockchain, IC design, new energy, etc

Investment Rounds

Seed to series B

Founded in 1951, the United Daily News Group (UDN Group) has chronicled news and history made each day for more than 70 years. Looking forward, the UDN Group continues to move to digital convergence for sustainable operation of its journalistic endeavors, aiming to make Taiwan a better place.

Gaviann Tseng / Senior Investment Manager

Portfolio

Funiverse Co, L'elan Enterprise CO, WritePath, ikala, GoodDeal, koodata, ischool , LaVidaTecCo, Jubo, FaceHeart, Ares

Fields of Investment

Tier 1: Curating, AI

Tier 2: Economy Data, Cultural and Creative/IP, Healthcare

Tier 3: Audio/Video, Education

Investment Rounds

PreA to Series B

Walden International was established in 1987 and is headquartered in San Francisco, USA, with offices in Silicon Valley, Taipei, Singapore, Beijing, Shanghai, India and Israel. Walden International manages more than US$2.6 billion in funds worldwide, with more than 500 investee companies in 12 countries, and successfully listed on 15 stock exchanges.

Samantha Lee / Investment Executive

Portfolio

The News Lens, Realbone Technolgy, Co., Ltd., etc.

Fields of Investment

Semiconductors and Electronics, Clean Tech, Health & Life Science, Consumer, Internet & Digital Media and Software, Emerging Technologies

Investment Rounds

Seed , early stage and expansion stage